Beyond the Bling: What a Diamond Price Chart Really Tells You

Why Understanding a Loose Diamond Price Chart Matters

A loose diamond price chart is a data-driven tool that shows average prices for diamonds based on their shape, carat weight, color, and clarity—helping you understand what you should expect to pay before you shop.

What You'll Find in a Diamond Price Chart:

- Price Per Carat (PPC) - The baseline cost for diamonds in specific weight ranges (0.5ct, 1ct, 2ct, etc.)

- Color Grade Pricing - How prices change from D (colorless) to K (faint yellow)

- Clarity Grade Pricing - Price differences from IF (internally flawless) to I3 (included)

- Monthly Updates - Current market trends and percentage changes over time

- Shape Variations - Different pricing for round, oval, princess, emerald, and other cuts

When you're shopping for a diamond for an engagement or anniversary, seeing numbers like "$4,294" for a 1-carat diamond or "$19,352" for a 2-carat diamond can feel overwhelming. But here's the truth: those numbers only tell part of the story.

Price charts track average asking prices across hundreds of thousands of diamonds. They're built from real-time data—like data from millions of loose natural diamonds or extensive industry inventory databases aggregated since 2001. These charts update hourly or monthly, showing you market movements and percentage changes.

But they don't show you everything. They typically reflect average or poor cut quality. A diamond with ideal proportions and superior brilliance can cost 10-15% more. They don't account for fluorescence, polish, symmetry, or the difference between a GIA-certified stone and one graded by a less rigorous lab.

That's why this guide exists. We'll decode what these charts actually tell you, what they leave out, and how to use them as a starting point—not the final word—when choosing a diamond that's perfect for your special moment.

Decoding Diamond Price Indices: The Wholesale Perspective

Before we talk about what you'll see when shopping for your diamond, let's pull back the curtain on how the industry itself tracks diamond values. This is where Diamond Indices come in—think of them like a stock market index, but for diamonds instead of companies.

These indices give professionals (and curious consumers like you) a data-driven view of what's happening in the diamond market right now. They track trends, price movements, and market sentiment across millions of stones.

What is a Diamond Price Index?

A Diamond Index is built from massive industry inventory databases that aggregate information from millions of diamond listings worldwide. It's essentially a benchmark that shows how diamond prices are moving over time.

Here's what makes these indices useful: they're updated constantly—sometimes as often as every hour. That means the data reflects almost real-time market activity. When you see a "percentage of change" on an index, it usually shows the difference compared to yesterday's closing time (typically 24:00 EST). This lets industry insiders track daily shifts and understand whether prices are trending up or down.

The index value itself is usually set to 100 at a specific starting point. From there, any movement up or down shows you exactly how the market has changed. If today's index reads 103, prices have risen 3% since that baseline. If it reads 97, they've dropped 3%.

This is the wholesale perspective—the view that dealers, manufacturers, and retailers use to understand market conditions. It's not the same as a consumer-facing loose diamond price chart, but it influences what you'll eventually see when you start shopping.

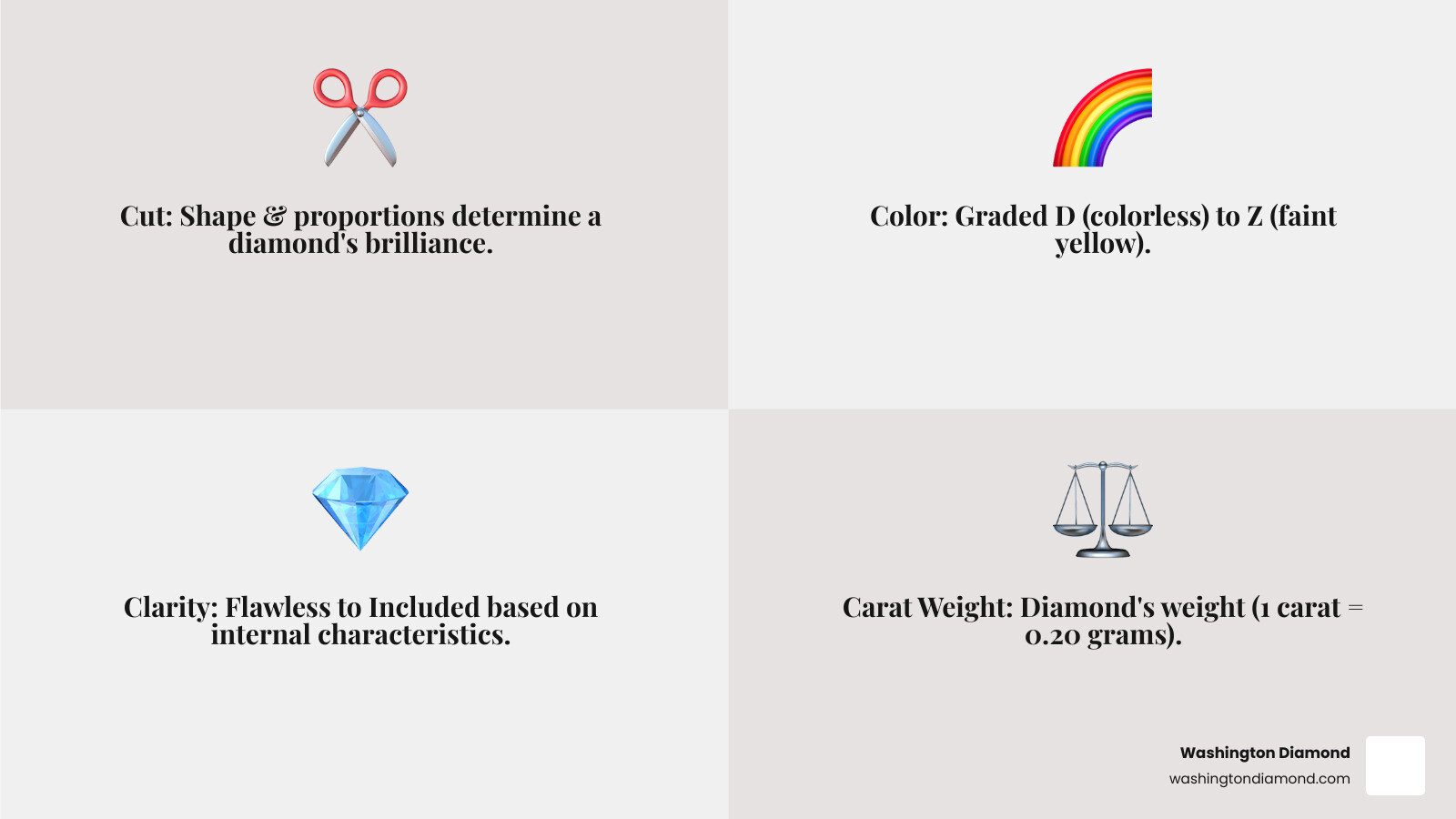

Understanding Diamond Drivers

Within these broader indices, you'll find something called Diamond Drivers. These are specific categories of diamonds tracked separately to show more detailed price movements. Instead of looking at "all diamonds," drivers break the market into meaningful segments.

Diamond Drivers are defined by shape (round, princess, emerald, cushion, oval, and others), carat weight ranges (like 1.00-1.49 carats or 2.00-2.49 carats), color grades (typically D-K or D-J), and clarity grades (such as IF-I1 or VVS1-SI2). Each combination represents a slice of the market with its own pricing dynamics.

For example, a round diamond between 1.00 and 1.49 carats with D-K color and IF-I1 clarity might make up about 12% of the market inventory. Its average asking price could be around $4,340, with a tiny daily change of -0.01%. Meanwhile, a larger round diamond in the 3.00-3.49 carat range with D-J color and IF-SI2 clarity might represent only 2.7% of the market—but command an average price closer to $18,268, with a -0.09% change.

These variations show you how different combinations of the 4Cs create entirely different pricing landscapes. A princess cut in the same carat range as a round might cost significantly less. An emerald cut might fall somewhere in between. Each driver has its own market share percentage, telling you how common (or rare) that particular combination is.

Understanding these drivers helps explain why two "1-carat diamonds" can have such wildly different prices. The interplay of shape, color, clarity, and exact carat weight creates a complex but fascinating pricing structure—one that reflects both supply and demand across the global diamond trade.

How to Use a Retail Loose Diamond Price Chart

While wholesale indices give us a broad market overview, retail loose diamond price charts are designed with you, the consumer, in mind. These charts translate complex market data into something you can actually use when shopping for your diamond. They're typically updated monthly to reflect the latest market trends, giving you a current snapshot of what diamonds are selling for right now.

These consumer-facing charts pull together data from millions of loose natural diamonds listed across the industry. They show you average prices per carat—or PPC—across different combinations of shape, color, clarity, and carat weight. Think of them as your starting point, a way to get your bearings before you begin your search.

And when you're ready to see how real diamonds measure up to these averages, we invite you to search and compare loose diamonds at Washington Diamond. Nothing beats seeing the actual stones that fit your budget and preferences.

Reading a Loose Diamond Price Chart for Key Shapes

Most loose diamond price charts let you filter by shape first, and for good reason. The shape of your diamond dramatically affects both its appearance and its price. Round brilliant diamonds are the perennial favorite—they're cut to maximize sparkle and brilliance, but this comes at a cost. Because cutting a round diamond wastes more of the rough stone than other shapes, rounds typically command the highest price per carat.

When you're looking at a chart for round diamonds (or any shape, really), you'll notice how the price per carat shifts based on the diamond's characteristics. Carat weight is a big driver. The price doesn't increase smoothly as you go up in size—instead, it jumps at certain magic numbers. A 0.99-carat diamond will cost noticeably less per carat than a 1.00-carat diamond, even though you'd be hard-pressed to see the size difference with your naked eye. It's all about crossing those psychological thresholds.

Color grades also play a significant role. As you move from D (perfectly colorless) down to K (which has a faint yellow tint), the price per carat drops. Sometimes the difference between a D and an E is invisible to anyone but a trained gemologist, yet the price gap can be substantial. It's one of those areas where understanding the nuances can save you money without sacrificing beauty.

Clarity works the same way. An internally flawless (IF) diamond is extraordinarily rare and priced accordingly. But here's a secret: many diamonds graded VS1 or VS2 have inclusions so tiny you'd never spot them without a jeweler's loupe. These "eye-clean" diamonds offer incredible value because they look flawless to you and everyone who admires your ring.

Let's put some numbers to this. For round diamonds, general price per carat trends might look something like this: A diamond in the 0.30-0.39 carat range could run anywhere from $1,500 per carat for a K color, SI2 clarity stone up to $4,000 or more per carat for a D color, IF clarity gem. Jump to the 0.90-0.99 carat range, and you're looking at $3,000 per carat on the low end and over $10,000 on the high end. Cross that magical 1.00-carat threshold into the 1.00-1.49 range, and prices start around $4,000 per carat for modest grades and can soar past $20,000 per carat for the finest stones.

To calculate what you'd actually pay, multiply the price per carat by the carat weight. If you're eyeing a 1.20-carat round diamond with G color and VS1 clarity, and the chart shows an average PPC of $5,000, you're looking at about $6,000 total. These are averages—each individual diamond has its own story, and its own price.

For a deeper understanding of how these characteristics come together to create value, take a look at our guide on Loose Diamonds.

What a Loose Diamond Price Chart Doesn't Tell You

Here's where we need to talk about what's missing from these charts. A loose diamond price chart is a fantastic tool, but it's not the whole picture. Think of it like looking at a restaurant menu—you get an idea of what's available and what it costs, but you don't know how it tastes until you try it.

The biggest thing most charts leave out? Cut quality. Many charts base their averages on diamonds with mediocre or even poor cuts. But cut is everything when it comes to how a diamond actually looks. It's what makes a diamond come alive with sparkle and fire. A diamond with an exceptional cut—what some in the industry call a "Super Ideal"—can cost 10-15% more than an average-cut diamond with the same color, clarity, and carat weight. And it's worth every penny. At Washington Diamond, we believe the cut is where the magic happens, so we focus on diamonds with superior proportions that maximize brilliance.

Fluorescence is another factor that charts often gloss over. This is the subtle glow some diamonds emit under ultraviolet light. In many cases, it's completely harmless and even desirable. But strong fluorescence in a high-color diamond (D through H) can sometimes make it look cloudy or oily, which can knock 15-25% off the value. On the flip side, a bit of blue fluorescence in a slightly yellow diamond can actually make it appear whiter—a happy accident.

Then there's polish and symmetry, the finishing touches that determine how perfectly a diamond's facets are aligned and how smooth its surface is. Excellent polish and symmetry help light move through the diamond flawlessly. Poor grades in these areas can reduce value by 5-10% and dull the diamond's sparkle.

Certification differences matter enormously, too. Not all grading reports are created equal. The Gemological Institute of America (GIA) and the American Gem Society (AGS) are the gold standard—their grading is strict, consistent, and unbiased. Other labs may be more lenient, meaning a diamond they grade as F color, VS1 clarity might only rate as G or H color, SI clarity by GIA standards. That difference translates directly to value. That's why we at Washington Diamond work exclusively with GIA and AGS certified diamonds, so you can trust what you're getting.

Finally, no chart can capture brilliance and beauty. Two diamonds with identical grades on paper can look completely different in person. One might dance with light while the other sits flat and lifeless. These subtle differences in how a diamond interacts with light are what make diamond shopping an experience, not just a transaction. This is exactly why we invite you to visit our private studio in Northern Virginia, where you can see these differences for yourself with our undivided attention.

'In-House' Diamond Listings

As you browse for diamonds, you might notice some are marked as 'In-House' listings. This designation means something important: these are diamonds the vendor has physically inspected and chosen to carry exclusively. Rather than simply listing every diamond available in a vast network, the vendor has done the work of pre-screening for quality, selecting only stones that meet their standards.

For you, this translates to confidence. When a diamond is in-house, the vendor knows it intimately—they've examined it under magnification, assessed its light performance, and verified that it lives up to its grading report. It's part of our commitment at Washington Diamond to offer you only diamonds we've personally vetted, ensuring that what you see is truly exceptional. This curated approach means every diamond we show you has earned its place in our collection.

Factors That Move the Needle on Diamond Prices

Diamond prices aren't static—they shift and change, influenced by a complex dance of global forces. From supply and demand to global events and market trends, the diamond industry responds to the world around it, much like any other precious commodity. Even the way diamonds are mined and brought to market plays a role in pricing.

Understanding these factors helps you see why a loose diamond price chart isn't set in stone. It's a living document, reflecting the ebb and flow of an industry shaped by both tradition and innovation. For centuries, diamonds have carried deep meaning and symbolism across cultures, which has always influenced their value. You can explore more about this fascinating history in our article on The Legend and Symbolism of the Diamond.

The Rise of Lab-Grown Diamonds and Market Impact

Perhaps the most dramatic shift in the diamond world in recent years has been the rise of lab-grown diamonds. These stones are chemically and physically identical to natural diamonds—they're real diamonds, just created in a controlled laboratory environment rather than formed over billions of years deep within the Earth. Scientists use techniques like Chemical Vapor Deposition (CVD) or High-Pressure/High-Temperature (HPHT) to replicate nature's process in a matter of weeks.

The price difference between lab-grown and natural diamonds is significant. Lab-grown diamonds typically cost 67-84% less than their natural counterparts. This affordability comes from their ability to be produced in large quantities, without the rarity factor that makes natural diamonds so precious.

As technology improves, production costs for lab-grown diamonds continue to decline. Better equipment, more efficient processes, and increased competition among suppliers have driven prices down year after year. What once seemed like a premium alternative has become increasingly accessible.

But here's what many shoppers don't realize: lab-grown diamonds have virtually no resale value. Unlike natural diamonds, which have generally increased in price over time and maintain significant value, lab-grown diamonds depreciate rapidly. There's currently little to no robust resale market for them. If you're thinking about the long-term value of your purchase, this is an important consideration.

When it comes to ethical considerations, lab-grown diamonds are often marketed as the more responsible choice. They're traceable, and they sidestep concerns about "blood diamonds." However, the production of lab-grown diamonds is energy-intensive and carries its own carbon footprint. Meanwhile, natural diamonds from reputable sources—like every diamond we select at Washington Diamond—come with strong ethical sourcing guarantees and are conflict-free. You can make a choice that aligns with your values either way. Learn more about what ethical sourcing truly means in our article What Does Ethically Sourced Actually Mean?.

The Importance of Diamond Certification

When diamond prices can vary wildly, certification is your trusted guide. A diamond grading report from an independent gemological laboratory gives you an objective, professional assessment of exactly what you're buying. Without a current, reliable certificate, accurately valuing a diamond—especially when it comes to subjective qualities like color and clarity—becomes nearly impossible.

At Washington Diamond, we work exclusively with diamonds certified by the Gemological Institute of America (GIA) and the American Gem Society (AGS). These two organizations set the gold standard for diamond grading. They're non-profit, meaning they have no financial incentive to inflate grades, and they're known worldwide for their strict, consistent, and unbiased evaluations.

Why does this matter for pricing? Because a GIA or AGS certificate ensures price reliability. When you see a diamond graded as F color and VS1 clarity by GIA, you know that's exactly what you're getting. You can compare it accurately with other diamonds and feel confident that the price reflects the diamond's true quality. Some labs use less rigorous standards, which means a diamond might be graded more generously than it deserves—leading you to potentially overpay for a stone that wouldn't earn the same grade from GIA or AGS.

These certifications provide objective evaluation, removing much of the guesswork. The report details not just the 4Cs, but also polish, symmetry, fluorescence, and precise measurements. Our experts at Washington Diamond can walk you through every detail of your diamond's certificate, helping you understand exactly what you're investing in and why it's priced the way it is. This transparency is part of our commitment to helping you make an informed, confident decision.

Frequently Asked Questions about Diamond Pricing

When our clients visit our private studio in Northern Virginia, they often arrive with similar questions about diamond pricing. Let's address the most common ones to help you feel confident as you begin your diamond journey.

How much does a 1-carat diamond cost?

The truth? There's no single answer to this question, and that's actually a good thing—it means there's a diamond for every budget.

A 1-carat diamond can range anywhere from around $2,500 to well over $20,000. The difference comes down to the 4Cs. An exceptionally rare 1-carat D color, Internally Flawless (IF) clarity diamond with an ideal cut might cost $20,000 or more. Meanwhile, a 1-carat K color, SI2 clarity diamond could be closer to $2,500.

Here's what's interesting: once these two diamonds are set in a ring, many people would struggle to tell them apart—especially if the more affordable diamond has a good cut. This is where expert guidance becomes invaluable.

The cut quality makes a dramatic difference in how a diamond appears. Even when color and clarity grades are similar, a diamond with superior cut proportions will look larger, brighter, and more beautiful. This exceptional craftsmanship typically adds a 10-15% premium, but we believe it's worth every penny. At Washington Diamond, we prioritize selecting diamonds with excellent cut proportions because we want your diamond to shine at its absolute best.

Why do prices jump at certain carat weights?

Have you ever noticed that a 0.99-carat diamond costs significantly less per carat than a 1.00-carat diamond, even though you'd need a magnifying glass to see the size difference? This fascinating quirk of the diamond market can actually work in your favor.

Diamonds are priced per carat, but the price-per-carat rate itself jumps at specific weight thresholds—typically at 0.50 ct, 0.75 ct, 1.00 ct, 1.50 ct, and 2.00 ct. A loose diamond price chart will show you these dramatic shifts clearly.

Why does this happen? It's a combination of consumer demand for those "round number" weights (there's something psychologically appealing about saying "a full 1-carat diamond"), the rarity of larger stones from rough diamonds, and the visual size difference that becomes more noticeable at higher weights.

Understanding these "magic numbers" can help you make a smarter purchase. Sometimes, choosing a 0.90-carat diamond instead of a 1.00-carat can save you hundreds or even thousands of dollars without sacrificing much visual presence. The physical difference is nearly imperceptible, but your budget will definitely notice.

Are diamonds a good investment?

This question usually comes from a practical place—you're making a significant purchase, and naturally, you want to know if it will hold its value. The answer depends largely on whether you're considering natural or lab-grown diamonds.

Natural diamonds have historically retained or even increased in value over time. While we don't typically recommend buying diamonds purely as financial investments, well-chosen natural diamonds—especially those of high quality and rarity—tend to hold significant value. They're tangible assets with centuries of desirability behind them. A 1-carat natural diamond from a reputable source like Washington Diamond maintains its worth far better than many other luxury purchases.

Lab-grown diamonds, however, tell a different story. Their prices have fallen consistently as production technology improves and supply increases. Currently, there's little to no resale market for lab-grown diamonds, meaning they lose much of their initial purchase price almost immediately. This reality is one reason why we focus exclusively on natural diamonds—we want to offer you pieces that not only symbolize your love but also hold intrinsic value for generations.

But here's what we believe most deeply: the true "investment" in a diamond transcends any market valuation. It's the sentimental value—the symbol of your commitment, the memory of your proposal, the heirloom passed down to your children. This emotional connection, this tangible reminder of life's most meaningful moments, is priceless. And that's an investment that never depreciates.

Conclusion: Using Price Charts to Find Your Perfect Diamond

Think of a loose diamond price chart as your starting point—a helpful compass that shows you the landscape of diamond pricing. It gives you real market data, helping you understand what different combinations of the 4Cs typically cost and how prices shift across carat weights, colors, and clarity grades.

But here's what we've learned together: these charts are wonderful tools, but they're not the whole story. They show you averages and trends, but they can't tell you about the way light dances through a perfectly cut diamond. They can't capture the moment when you see that one stone and just know. And they certainly can't convey the difference between a diamond that's merely acceptable and one that takes your breath away.

The numbers matter, absolutely. But so does the sparkle. So does the way a diamond looks when you hold it in your hand, turn it in the light, and imagine it on the finger of someone you love.

That's why we created our private, appointment-only studio in Northern Virginia. When you visit Washington Diamond, you're not competing for attention in a crowded showroom. You have our complete focus. We can take the time to show you what the charts don't reveal—how a superior cut transforms a diamond's brilliance, why certain proportions create more fire, and what difference excellent polish and symmetry make when you see two diamonds side by side.

We'll walk you through the certifications, explain the nuances of fluorescence, and help you understand why two diamonds with identical grades on paper can look completely different in person. Most importantly, we'll help you find the diamond that speaks to your story, not just one that fits a price point.

Your perfect diamond is out there, waiting to become part of your most cherished memories. Let the price charts inform your search, but let your eyes and heart make the final choice. We're here to guide you through every step, ensuring you make a decision you'll feel confident about for years to come.

Before you begin your diamond journey, we encourage you to explore our comprehensive guide: Calculate the Value of a Diamond Before You Buy or Sell